QP/401(k) Separation From Service Distribution Request Form 2007-2026 free printable template

Show details

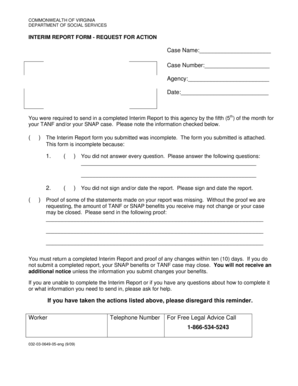

Page 1 of 2 2007 Ascensus Inc. Using the QP/401 k Separation From Service Distribution Request Form Your plan permits you to withdraw your vested account balance when you separate from service with your employer due to termination disability or separated from service for one of those reasons and you would like a distribution of all or a portion of your vested account balance please read the instructions below and complete the Separation From Service Distribution Request Form that accompanies...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 401k separation from distribution form

Edit your paychex 401k withdrawal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 401k withdrawal form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit paychex 401k withdrawal form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out the qp 401 k separation from service distribution request they have separated from service with their employer form

How to fill out QP/401(k) Separation From Service Distribution Request Form

01

Begin by obtaining the QP/401(k) Separation From Service Distribution Request Form from your plan administrator or the company website.

02

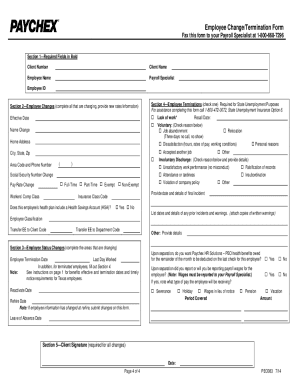

Fill in your personal information, including your name, address, Social Security number, and contact details.

03

Indicate the reason for your request by checking the appropriate box, typically 'Separation from Service'.

04

Provide details about your employment, including your employer's name and your job title.

05

Specify the type of distribution you are requesting (e.g., lump sum, rollover, and any specific options available to you).

06

If applicable, indicate how you would like your distribution to be paid out (directly to you, rolled over to another account, etc.).

07

Review the tax implications and option available to you, and make your selection accordingly.

08

Sign and date the form to confirm that all the information you've provided is accurate.

09

Submit the completed form to your plan administrator or the specified department to process your request.

Who needs QP/401(k) Separation From Service Distribution Request Form?

01

Individuals who have separated from their employer and wish to access or transfer their 401(k) retirement funds.

02

Employees who have retired or left their job and need to initiate a distribution of their retirement savings.

03

Anyone who is considering rolling over their 401(k) into another retirement account or investment vehicle.

Fill

401k distribution form

: Try Risk Free

People Also Ask about sentry 401k withdrawal form

How do I request a distribution from my 401k?

Wait to Withdraw Until You're at Least 59.5 Years Old By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax. You'll simply need to contact your plan administrator or log into your account online and request a withdrawal.

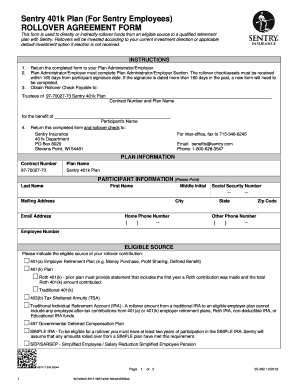

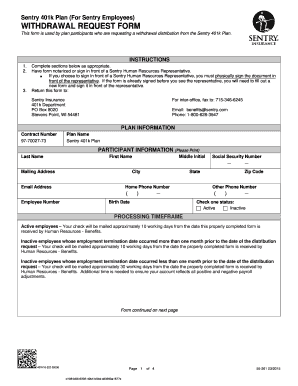

What is a 401k distribution request form?

This form may be used if you have separated from service due to termination, disability, or attainment of normal retirement age and you wish to withdraw funds from the plan. PARTICIPANT. INFORMATION.

How do I distribute my 401k after retirement?

After you retire, you may transfer the money in your 401(k) to another qualified retirement plan, such as an individual retirement account (IRA). This may be a good idea if you're looking for more investment options. To transfer your 401(k) to an IRA, you can request either a direct rollover or a 60-day rollover.

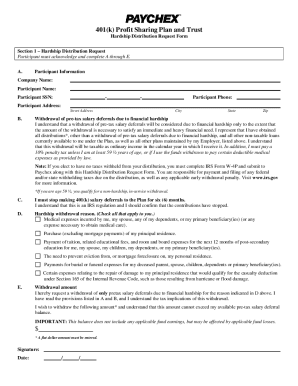

What is a distribution request form?

This form is used to request a reportable distribution of assets from Traditional IRAs, SEP IRAs, SIMPLE IRAs, Roth IRAs, Education Savings Accounts, Inherited IRAs, and Inherited ESAs.

What does it mean to request a distribution from 401k?

Distributions. A 401(k) distribution occurs when you take money out of the retirement account and use it for retirement income. The IRS counts distributions as taxable income and taxes you based on your income tax bracket.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 401k separation service distribution in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign qp form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit qp 401 k distribution form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your paychex flex 401k withdrawal to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the service distribution request electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your separation from service and you'll be done in minutes.

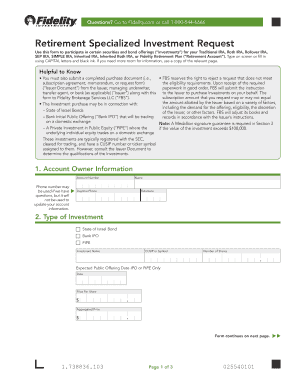

What is QP/401(k) Separation From Service Distribution Request Form?

The QP/401(k) Separation From Service Distribution Request Form is a document used by employees to request the distribution of their 401(k) retirement plan funds after they have separated from service with their employer.

Who is required to file QP/401(k) Separation From Service Distribution Request Form?

Employees who have terminated their employment and wish to withdraw their 401(k) plan benefits are required to file the QP/401(k) Separation From Service Distribution Request Form.

How to fill out QP/401(k) Separation From Service Distribution Request Form?

To fill out the QP/401(k) Separation From Service Distribution Request Form, you will need to provide personal information such as your name, social security number, and the details of your separation from service, along with the amount you wish to withdraw and your preferred payment method.

What is the purpose of QP/401(k) Separation From Service Distribution Request Form?

The purpose of the QP/401(k) Separation From Service Distribution Request Form is to formally request the withdrawal or distribution of funds from a 401(k) plan after an employee has left their job, ensuring the process is documented and complies with plan requirements.

What information must be reported on QP/401(k) Separation From Service Distribution Request Form?

The form must report information including the account holder's personal identification information, the date of separation from service, the reason for distribution, the amount requested, and the desired method of payment (e.g., direct deposit, check).

Fill out your QP401k Separation From Service Distribution Request Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Rollover Form is not the form you're looking for?Search for another form here.

Keywords relevant to 401 k separation

Related to eligibility criteria for the qp401k the plan document is advisable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.